Turnaround

Finding light at the the end of the tunnel

Getting started

A successful turnaround requires a viable core business, a product or service that customers want, stakeholders who are committed and support the business, the right people to manage the turnaround, and availability of financing to support the implementation of a restructuring plan and deliver results.

Time and money are the biggest constraints in a turnaround, and the window of opportunity to stabilise the situation, analyse the problems and implement the change is usually very short with no margin for triall and error.

We begin every turnaround by working collaboratively with you to answer seven questions so that we can get straight to the point of what needs to be done and expedite a tailored strategy and financing solution aligned with the needs of your business.

- Is the core business viable?

- Are the key stakeholders onboard?

- Is management credible?

- Has reputation suffered?

- Will suppliers offer credit?

- Is internal/external funding available?

- Can cash flow fund operations?

Put simply, a business is viable if it has more revenue coming in than it costs to run.

Viability is not the same as solvency or liquidity. Solvency means there are enough assets in the business to cover its liabilities. Liquidity means having the ability to turn the company's assets into cash without loss when the business needs it.

But a viable business needs more than just having your financial house in order. It also means being competitive - having a clear picture of your identity in the market, what you are selling, who you are selling to and who else is selling to them.

In addition to reviewing your current financial ratios, our experts will review the unique value proposition of your business, examine your customer base for signs of stability, and look at the marketplace in which you operate to understand who your competitors are and what they are doing.

We will use a set of financial ratios to show analyse and assess the current health of your business compared to others in the same sector. These include:

Current Ratio (Current assets/Current liabilities)- an indicator of whether or not the business if sufficiently resourced to pay its bills over a given period. A ratio of 1.0 or above is good.

Total Debt Ratio (Total debt/Total assets) - an indicator of long-term solvency which should be below 1.0. Businesses with high total debt ratios can be in danger of insolvency.

Profit Margin (Net income/Gross Sales) - a percentage indicator of how much income is generated for every pound of gross sales. Measured over time this indicates how well your business has performed over time compared to how it is performing now.

Debt-to-Equity Ratio (Total debt/Total assets) - an indicator of the total amount of debt carried by company vs. the amount invested by the shareholders. Debt-to-Equity Ratios are benchmarked by industry and if you are in need to debt or equity financing, this ratio will be closely scrutinised by lenders or investors as it is a measure of risk that the business carries.

While profit margin and current assets ratios can look strong, carrying too much debt will interfere with cash flow and affect your ability to operate as well as invest in marketing activities. We help apply these rations and review your marketing strategy to provide a quick health check for the business.

Your stakeholders are those with a vested interest in the success of your business, and for most business owners this means your primary focus has always naturally been on your customers.

In a financial crisis it's easy to assume that all the focus changes to the financiers who are supporting your turnaround.

In reality every business has a broad range of stakeholder groups with their own characteristics and specific concerns about your situation:

- Board of Directors

- Shareholders

- Investors

- Debt &/or Equity Financers

- Customers

- Employees

- Landlords

- Suppliers

- Partners

- Government

- Regulators

- Industry Bodies

- Local Communities

- Employees

- Unions

- Media

- Creditors

The challenge of convincing stakeholders that restructuring is a better option than termination or winding-up depends on successfully mapping and analysing these competing interests.

We will develop a stakeholder map to guide and prioritise a strategic stakeholder communications plan that covers who to communicate with, what message will be communicated, when and how communication will happen, and the channels to be used, i.e. in-person, virtual, phone, email, newsletter, social media, online platforms etc.

Our specialists will manage the process of rebuilding confidence and bridging knowledge gaps with stakeholders, opening lines of communication, building positive attitudes towards the company and the turnaround process, and taking the pressure off CEOs and senior management.

Understanding each stakeholders' agenda, empathising with what's important to them, managing their expectations and how they perceive the company, being honest, open, factual and to the point, and prioritising and fixing their problems are all actions geared towards getting stakeholders aligned and on board with the turnaround.

Businesses fail because of mismanagement, deliberate or otherwise.

In our experience, one of the most important steps for businesses going through significant change is establishing a leadership team equipped with the unique skillset to successfully complete the turnaround while guiding the management team to a new level.

Our professionals have all done this before and are adept at bringing new skills and ideas that produce benefits, provide accountability and credibility, and help management take and implement the difficult decisions, such as restructuring, layoffs, or changing the business model.

Working collaboratively - often as independent directors and interim managers - we shape a process that establishes continuity and allows everyone to expect orderly change and opportunity as the turnaround progresses. We seek out available and under-utilised human capital - often middle managers who are dedicated to the company and its success - to take the company to the next big step.

In the eyes of investors and other stakeholders, the value of a company increases sharply with a strong, permanent, credible team who can demonstrate clear thinking, quickly determine what is wrong, develop strategies that no one else has tried before, and implement plans to restructure the company, produce consistent sales, profit and cash-flow results.

Credible management sends the message that you are an organisation with leadership, guidance, and stability. In a turnaround this is essential for several reasons:

Securing funding - convincing lenders or investors to provide the necessary funding.

Gaining stakeholder trust -convincing various stakeholders (e.g., investors, employees, creditors, customers) to continue their support despite the company's current problems.

Motivating employees - inspiring and motivating employees with a clear vision and viable plan for turning things around.

Implementing difficult decisions - reducing the workforce, changing product or service offerings, reducing costs, improving operational efficiency, negotiating with creditors, suppliers, and investors, and making changes to the organisational structure and culture.

A turnaround management team must do more than identify problems and implement solutions. The success of the turnaround effort across the lifecycle pivots on management creating and sustaining credibility with every stakeholder.

Before or during a turnaround, a company's reputation, as well as that of its owners, may be adversely affected. This is often due to financial difficulties, but can also be the result of other challenges, including negative but high-profile media coverage, social media posts, rumours, union activity or other challenges.

Corporate reputation is a crucial asset for any business and can impact a company's ability to gain customer trust, attract new customers, and retain talented employees. More importantly in a turnaround, a negative corporate reputation can seriously impair the ability to attract investors and secure partnerships with other businesses.

We conduct a communications audit at the outset of every turnaround assignment to benchmark stakeholder sentiment. This drives a strategy aimed at rebuilding damaged reputation and restoring confidence through pro-active stakeholder engagement internally and externally.

Our corporate communications experts understand that Investors and partners are more likely to work with companies that have a strong track record of success and a reputation for ethical and responsible behavior.

Ultimately, a strong corporate reputation is a valuable asset that contributes to a company's long-term success. Integrating robust reputation management at every stage of the turnaround lifecycle creates the probability of emerging stronger, more resilient, more competitive, and and with a reputation that is wholly intact.

For a supplier to extend credit to a company in a turnaround is a complex judgment call that requires careful communication of the company's financial condition, credit terms being offered, consideration of the relationship with the company, and what the competition may offer if the supplier says no.

The decision hinges on the supplier having reassurance that the company can turn its finances around and that the credit terms being proposed are favourable. Ideally, extending credit in the short-term should be preferable to losing a customer in the long-term, and this is where we step in.

Our professionals are experienced in negotiating with suppliers who may be uncertain about the company's ability to repay and consider extending credit not worth the risk. We help work with suppliers in four key areas:

Bringing the supplier into the plan - suppliers are concerned about the financial condition of the company and it is essential that they not only understand the plan being put in place to turn finances around, but the importance of their role in the plan. We look at the possibilities of achieving early wins with critical suppliers, and the potential to demonstrate progress by making good on commitments.

Negotiating realistic credit terms - suppliers want to minimise their risk. We aim to create packaged solutions around the terms of the credit they are extending, including interest rates, repayment periods. and any security such as collateral or personal guarantees.

Leveraging the relationship - with credit solutions baked into the turnaround plan we seek to leverage the value of suppliers' relationship with the company. Extending credit becomes a much more viable option if the company has been a reliable customer in the past and has shown a willingness to pay its debts.

The competition - if suppliers refuse to extend credit we help you look for another supplier who is willing to take the risk. Existing suppliers often balance the potential loss of business against what the competition can offer.

We work with you and your suppliers to resolve their questions and craft robust solutions to keep credit lines open throughout the turnaround lifecycle.

When a company in a turnaround situation needs funding to successfully recover from financial difficulties, both external and internal sources should be carefully considered. We help you unravel the differences between the two and ultimately to ensure the decision works best for the business. Some considerations include:

Control & ownership - funding generated by the company can mean retaining control over and ownership of the business. Investors, lenders or creditors - all sources of external funding - can result in a loss of ownership or control of the business by giving significant equity to those who provide the funds.

Access to funding - investors and lenders may be hesitant to provide financing to a company in a turnaround situation, making it challenging to gain acmes to external funding options. We help identify internal funding that may be more readily available to the business, such as cash reserves or assets.

Cost - external funding comes at a cost, usually in the form of equity, interest on loans or share of profits. Internal funding is usually considerably less expensive as the company is not obliged to pay interest or dividends to itself.

Risk mitigation - with the company having to meet strict performance targets or face the consequences of defaulting on loans, external sources of funding carry more risk. Internal sources of funding lower this risk with the company and its management having greater control over cash flow and the financing.

In a turnaround situation, it is essential to carefully consider both external and internal sources of funding to determine which options best suit the needs of the business. A combination of both sources may be necessary to provide the capital required at each stage in order to implement a successful turnaround plan.

Positive cash flow means that a company's liquid assets are increasing, enabling it to settle debts, reinvest, return money to shareholders, pay expenses, and provide a buffer against future financial challenges.

In a business turnaround, cash flow determines whether a company can continue to operate. Negative or insufficient cash flow indicates that a company's liquid assets are decreasing. This can rapidly turn into a cash crunch, making it challenging to pay bills, meet payroll, and fund ongoing operations.

At the outset of every turnaround assignment our experts review and analyse the financials to determine if cash flow is sufficient and what can be done if it isn't.

Review financial statements - historical and current financial statements provide the best indication of a company's current financial health and future outlook. Reviewing cash flow statements, balance sheets and income statements help us to rapidly ascertain if the company has enough cash flow to fund operations.

Undertake a cash flow analysis - a deeper dive identifies where cash is coming from and where it is going to. Reviewing these cash inflows and outflows provides the insights to drive the immediate actions required to keep operations going.

Determine a future cash flow forecast - it is critical to identify potential cash flow shortfalls before they occur. We examine projected sales, expenses and other factors to establish a predictive cash flow forecast and anticipate future needs.

Develop a cash flow management plan -if cash flow is insufficient we step in to develop a cash flow management plan. This will most often include reducing expenses, delaying payments, collecting accounts receivable more quickly, or seeking additional financing. By challenging accepted practices and thinking creatively, surprising benefits can be achieved through bringing discipline to cash management, and these often lead to operational improvements that alleviate pressure from creditors.

Consider external financing options - External financing options, such as loans, lines of credit or equity investment may be the only option to address cash flow shortfalls. We will help you carefully consider the implications, terms and costs of the most appropriate external financing options that will support the restructuring plan.

Cash control and ongoing cash flow vigilance is the top priority in the initial stages of a turnaround assignment. Accurate cash flow forecasting stems the bleeding, stabilises the vital signs, and most importantly, informs the essential decisions on viability of the core business, operational improvements, and projected turnaround outcome.

What to expect during a turnaround

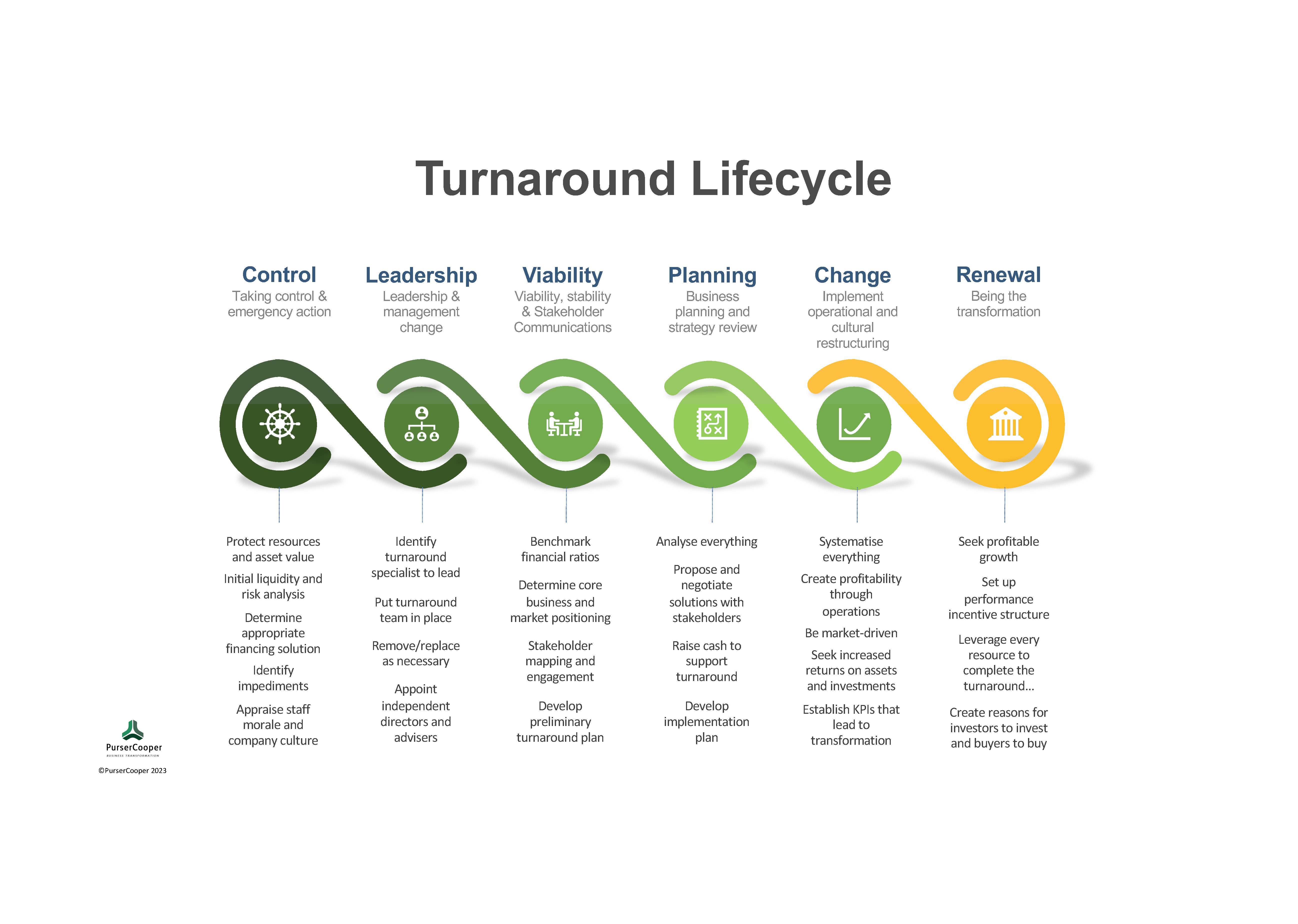

The turnaround lifecycle goes through six focused stages: Control - taking control and emergency action; Leadership - leadership and management change; Viability - viability, stability & stakeholder communications; Planning - business planning and strategy review; Change - implement operational and cultural restructuring; Renewal - being the transformation. Coordinating the functions of the company across the activities in each stage in key to success.